YOUR QUOTE IN 2 MINS

1 (855) 997-0668

+110 Broker Partners in Quebec.

Compare Life Insurance Price from +20 Insurers. -

Ask your Quote in 2 Minutes

Get a Free Quote for your life insurance

Compare Different Life Insurance offers and select the Best, simply by filling out the from below

Life insurance vs. Mortgage life insurance vs. Mortgage insurance: let’s clear this up!

Nothing’s more confounding when shopping around for a mortgage than immersing yourself in the insurance domain. Your bank suggests you take a mortgage life insurance, your friend says you should subscribe to a life insurance and then you’re told you need mortgage insurance. You feel completely lost and you want to know the difference between those options but mostly, why you should contract several insurances. 90% of the buyers believe mortgage-related insurance is complex and hard to understand during the buying process. This notion is definitely worth your attention since it is vital for your financial future and that of your family.

Mortgage life insurance: a protection for you, and your bank!

When in front of your banker to sign your mortgage, he will ask you one thing: do you wish to subscribe to mortgage life insurance for protection? Your first reflex should be: is it really the best solution? In fact, mortgage life insurance pretty much covers only your financial institution in case of death or personal disability on your part. Your initial coverage sum corresponds to the amount of your debt and your coverage decreases over the years as you repay your mortgage. For example, if you secure a 225, 000$ mortgage on year one, your coverage, following your passing or another valid reason, would encompass that amount. 20 years later, your mortgage amount now down to 35,000$, your sudden demise (or another reason) would mean only a 35,000$ pay out from the bank.

The amount covered is always the same as your mortgage amount and your premiums are based on your age and a brief medical examination. Furthermore, if you ever do business with another lender at your mortgage loan’s renewal, you would have to start the whole process over and renegotiate a mortgage life insurance with your new financial institution. It could be a hard and tiring task.

As for your premiums, Desjardins calculate them by adding interest percentage points to your borrowing rate. Most of the other financial institutions establish cost rates for each 1,000$ of coverage depending on the age and sex of the individual. Premiums can be determined in various ways depending on your bank.

This insurance exists mainly to defray your mortgage’s remaining balance, whatever the amount. Your coverage and mortgage go down at the same time so only the financial institution truly benefits from it. It means that after your passing, the bank will receive the money and pay your mortgage’s balance. Your property, now fully reimbursed will be given to your heirs. Basically, all your life you’ll contribute for an insurance whose only goal is to pay off your mortgage’s balance with a progressively decreasing coverage. If your mortgage is completely reimbursed, your mortgage life insurance ceases to cover you and becomes useless.

Think about it twice before getting this financial product, it’s generally more expensive and doesn’t offer you an optimal guarantee. It’s pretty advantageous for the lender, but for you? That’s where you ask: is there a better alternative? I’ll let you be the judge of that!

Life insurance: coverage fit for you and your family!

There’s an alternative to mortgage life insurance. In fact, very often it is far more advantageous to subscribe to a private life insurance from a life insurance company then to contract one with your financial institution. These two products are different in many ways.

A private insurer will give you ample possibilities to choose your coverage amount for a life insurance. If your mortgage is 225,000$, you can pick a 225,000$ sum or 300,000$ if you want to leave more money in the inheritance. Furthermore, this amount will NEVER diminish over the years. 20 years later, if your mortgage which started at 225,000$(your mortgage debt) is now down to 35,000$, your heirs would still receive a sum of 190,000$ cash and your property would be mortgage-free. A more attractive solution, don’t you think?

Insurance companies also offer another financial product which consists of a decreasing coverage. Basically, you subscribe to (let’s say) a 100,000$ insurance which decreases according to the capital you pay to a maximum of 50%. It means your coverage diminishes over the years according to your mortgage, but it will never attain 0 like a mortgage life insurance offered by a bank. You’ll always be certain to obtain 50% of the determined coverage amount at the contract’s signature. This type of policy is less expensive than the total coverage which never varies. It can address the needs of customers with smaller budgets. Not only does it cost less than the usual life insurance, your capital also never goes under 50,000$ (in this example).

To determine your premiums, your insurer will have you go through a far more exhaustive battery of medical tests than your usual financial institution’s to precisely assess your state of health. Your premiums will better reflect the associated risk rating and you’ll pay the right price. Furthermore, even if your state of health declines over the term of your insurance, you’ll remain insured and you’ll keep your coverage. Usually, premiums from a private insurer are less onerous than those of a financial institute. You have no obligation towards your bank and can go wherever you like to contract life insurance.

Life insurance can be used to defray the taxes your beneficiaries will incur during the estate. You determine your beneficiaries, not the bank. When you pass, your heirs receive the coverage amount to pay your mortgage and keep the rest. Your lender has nothing to do with it! The coverage amount can also reimburse some other debts you could have acquired over time (car, personal, etc.) or simply be left in the inheritance.

This alternative gives you more flexibility in setting the terms and conditions of your life insurance and allows you to get maximum coverage at a low price.

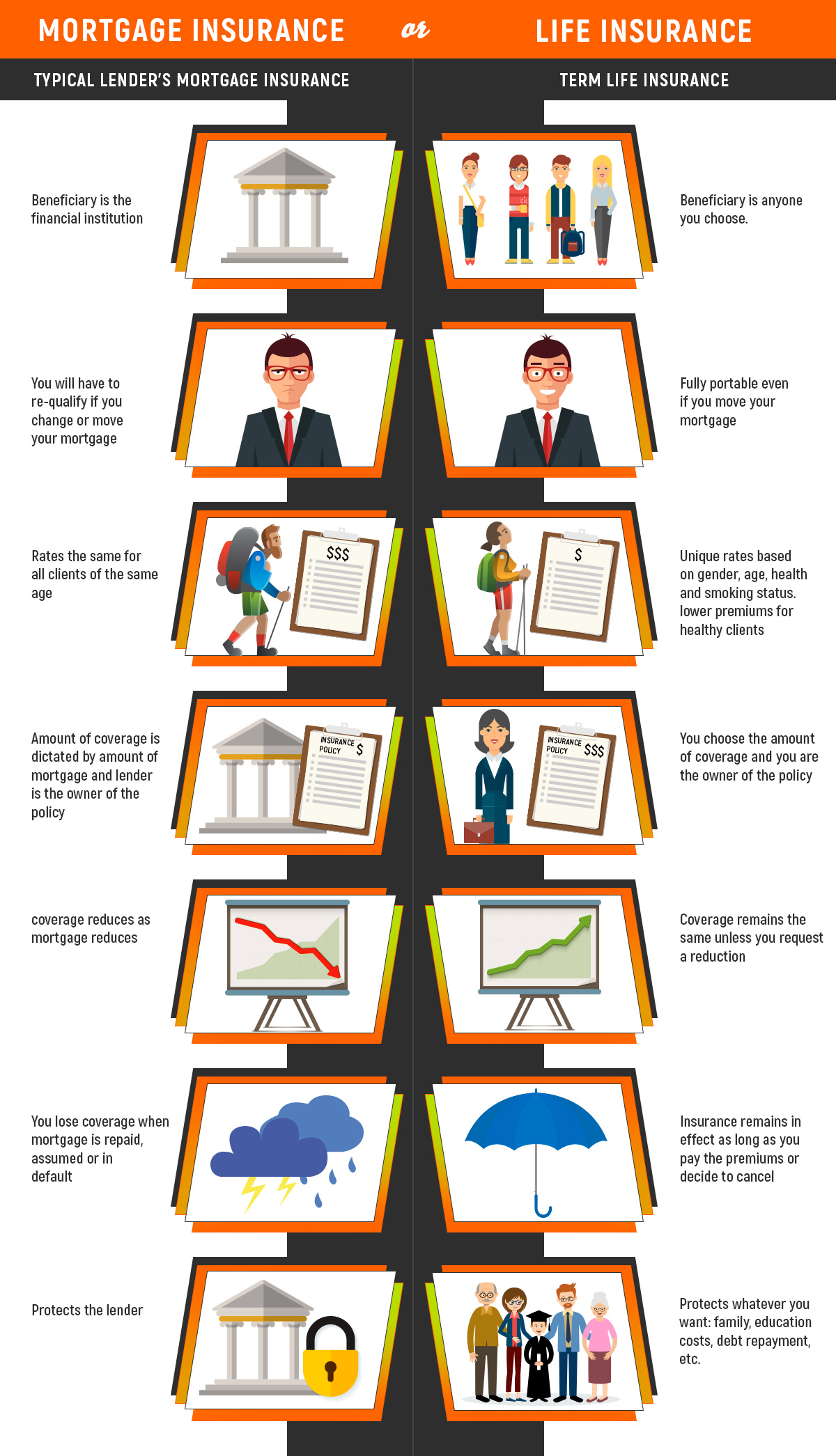

Life insurance vs. Mortgage life insurance: the key differences!

It’s possible you’re still confused about the two. It’s only natural, it’s not easy to grasp everything about the life insurance world. To help you get a better understanding, here’s a comparative table showing the main differences between life insurance from a private insurer and mortgage life insurance from a mortgage lender. It will unravel the subtleties and advantages of each alternative.

As you can see, more often than not, life insurance from a private insurer is more advantageous than mortgage life insurance offered by a financial institution. Life insurance is much more adaptable in terms of coverage, beneficiaries or rates, depending of your situation, of course. One thing for sure, to get the best out of life insurance, you must shop around! We’ll talk about that later.

Mortgage insurance: what about it?

Another type of insurance! If you ever owned a house or thought about buying one, somebody probably explained to you its purpose and why you need one. It’s really important to understand it because it’s very different from the two insurances we talked about so far.

In Quebec, it’s well known that you can buy a property with only a 5% down payment. This claim is true, although not completely. In fact, normally you need a 20% down payment to acquire a house. If you can’t provide that amount, you then need to subscribe to what’s called “mortgage insurance.” This insurance covers and protects your bank in case of non-payment from your part or bankruptcy. The Canada Mortgage and Housing Corporation (CMHC) put this measure in place to facilitate property access to everyone.

All buyers who wish to acquire a property by providing less than a 20% cash down on the price of the house must subscribe to mortgage insurance. It’s fairly easy to proceed from there: your lender pays a premium to CMHC when you contract your mortgage and the bill is then relayed to you. You’ll have the choice to pay right away the whole sum or add it to your mortgage amount. To determine your premium cost, CMHC has prepared a little comparative table presenting the premium percentage paid depending on the down payment provided by the buyer.

Premiums table (CMHC)

| Loan-to-Value | Premium on Total Loan | Premium on Increase to Loan Amount for portability |

| Up to and including 65% | 0.60% | 0.60% |

| Up to and including 75% | 1.70% | 5.90% |

| Up to and including 80% | 2.40% | 6.05% |

| Up to and including 85% | 2.80% | 6.20% |

| Up to and including 90% | 3.10% | 6.25% |

| Up to and including 95% | 4.00% | 6.30% |

| 90.01% to 95% —

Non-Traditional Down Payment |

4.50% | 6.60 % |

Image source : https://www.cmhc-schl.gc.ca/fr/co/asprhy/asprhy_005.cfm

It is very likely that you’ll need to get mortgage insurance on top of life insurance if you can’t provide a 20% cash down on your future property. Please note that life insurance and mortgage life insurance are not mandatory while the CMHC mortgage insurance is compulsory to secure a loan (with a down payment fewer than 20%). Without it, banks wouldn’t be able to approve loans to buyers who can’t put more than 5, 10 or 15% as a down payment. It’s an insurance meant to facilitate the access to property.

Some helpful tips and advice about insurance!

When shopping around for insurance keep key elements in mind.

- You don’t have to subscribe to life insurance or mortgage life insurance while acquiring your mortgage. You can get one later.

- Mortgage life insurance can often be canceled free of charge when you do business with your financial institution.

- Ask your employer if you already possess life insurance, you could simply increase your coverage.

- If you own rental properties, these won’t be exempted of taxes in the estate. Look ahead for the future and plan these expenses by adjusting your coverage accordingly.

- Always ask for several quotes when searching for life insurance to compare them with your bank’s mortgage life insurance.

- What are your investments and what is your financial situation? Are you leaving enough money to your heirs to take care of your debts?

These few tips can allow you to identify your needs and find the ideal coverage. It will be important to proceed to an in-depth analysis of your personal financial situation when acquiring life insurance in order to get the best price and coverage according to your requirements.

Tired of paying too much? Ask for several quotes!

We always fear to pay too much when comes the time to negotiate premiums. The best way to make sure to score a good deal is undoubtedly to ask several quotes from different insurance brokers. Doing so will save you thousands of dollars in the long run and you’ll be able to compare prices with different insurers to determine which one of them will make the best offer. The worst way to go is to accept the first one without analyzing what’s available elsewhere on the market.

Furthermore, you must understand the financial products available to you to pinpoint the one you truly need. As you can see, life insurance from a private insurer is generally more advantageous than a mortgage life insurance offered by a financial institution. To make sure you get the right price for your insurance, ask for 3 quick quotes with our free online form.

To allow you to grasp the practical differences between the offers presented by a financial institution and a mortgage insurance broker, we prepared a comparative table showing the distinctions between the two. You’ll easily realize which offer is best for you.

Comparative Table: Desjardins Group Insurance vs. Mortgage Insurance Broker

When comes the time to choose between mortgage life insurance offered by your institution and life insurance suggested by your insurer, it can be difficult to understand firsthand the subtleties and distinctions between the two. We elaborated a comparative table between a Desjardins offer versus one originating from a mortgage broker to help out a bit.

| Desjardins | Mortgage Broker | |

| Who owns the contract? | Desjardins | YOU |

| Who’s the beneficiary? | Desjardins | The person of your choice (your spouse, your children, your parents, etc.) |

| What type of insurance is it? | Group Insurance | A PRIVATE insurance |

| What happens if I die? | Desjardins has 90 days to verify if you were truly insured at the time of enrollment. During that time, your heirs must take care of your mortgage payments while Desjardins closes its investigation. | Your beneficiaries receive the money and reimburse the mortgage amount themselves. If the mortgage balance is lower than the insurance amount, your beneficiaries keep the rest. |

| How are the premiums calculated? | Premiums paid are measured according to the state of health of all your financial institution’s consumers. | According to YOUR state of health. |

| Are premiums guaranteed for the duration of my loan?

|

No. Furthermore, premiums are based on an additional annual interest rate applied to the net debt. Each renewal means premiums are revised depending on your age. | Premiums are guaranteed for the duration of your loan. |

| If I’ve had health problems in the past, can I be insured? | You have a vested right on your insurance if it was taken before your health problems. If you renegotiate your mortgage or wish to switch to a new financial institution, you’re at risk of becoming uninsurable. | YES |

| What happens if I wish to switch financial institutions?

|

You’ll have to cancel your current insurance and contract another. Your premiums will rise because you’ll have advanced in years. | You can switch financial institutions without problems. Your insurance follows you everywhere. |

| Who can be insured on the mortgage? | Your spouse or the collateral, if need be. | Anyone (with their consent). |

| What is the amount that I can insure? | Only the mortgage amount. | The amount of your choice. |

| Is my insurance flexible? | No | Yes. You can transform your mortgage life insurance into whole life insurance. |

| If I reimburse my mortgage sooner, does my insurance still remains? | No, the insurance ends as soon as the loan is paid off. | Yes, since your PRIVATE mortgage life insurance is not directly linked to your mortgage. |

| Do vendors receive training to sell insurance? | No, there are no precise regulations for insurance sold in the caisses. | Yes, all the advisors are duly licensed from the AMF and must follow continuing education units to keep practicing. |

| What are the admission requirements? | A new loan at Desjardins. | Any loan acquired from a financial institution. You can combine several loans into one insurance contract. |

| Will I receive a document showing the terms of the insurance contract? | Your insurance contract is available upon request. | Yes, it will be given out to you in person. |

As you can see, Desjardins is the owner AND the beneficiary of your coverage and has 90 days to go back and verify your insurability when you enrolled. It’s a way to proceed that might anger some and can cause nasty surprises. Furthermore, the amount of your policy is calculated according to the average state of health of people your age and not according to yours. With a private life insurance, you’re the owner of your policy and you pick yourself your beneficiary. Your health status determines your premiums and they’re guaranteed throughout your mortgage.

To summarize, the insurance offered by your bank is often far from being the best solution for you. It shows no flexibility at all. In that Desjardins example, we see the possibility for you to become uninsurable if you decide to refinance your mortgage and your health starts to fail you. The individual who explains the financial product is a simple representative, while brokers from private insurance companies are licensed advisors from the AMF who must follow continued education units to keep practicing. You can notice right away that private insurance companies offer a more professional approach and their coverage are best adapted to the customer’s needs.

Life insurance from a private company: the best solution for you!

In a nutshell, there are 3 types of insurances to understand: life insurance, mortgage life insurance and mortgage insurance. Their names are very similar and you must comprehend each one’s subtleties to avoid costly mistakes.

| TYPE OF INSURANCE | IN BRIEF |

| Life insurance | Insurance where coverage is fixed at the beginning of the contract and remains the same throughout the agreed upon period. You’re the sole proprietor and you choose your beneficiaries. You select your coverage amount, it can be higher than your mortgage. The premiums are determined by YOUR state of health. Allows more flexibility and is personalized according to the client’s wishes. |

| Mortgage life insurance | An insurance where your coverage decreases as your mortgage amount diminishes as well. The total of the policy is calculated with average statistics from the population. Premiums are interest percentage points added to your payments. The bank is the owner and beneficiary of the police. Fixed and based on massing studies, this type of insurance is often more onerous. |

| Mortgage insurance | An insurance which protects the financial institutions in a mortgage situation where a buyer can procure less than a 20% down payment on the sale price. This insurance reduces the risk of non-payment from the client. Premiums are charged to the buyer who can decide to pay the whole sum right away or add it to the loan amount to amortize it. |

Finally, when the time comes for you to contract a mortgage insurance to cover you in case of death and disability, consider subscribing to a life insurance from a private insurance company instead of settling for the mortgage life insurance offered by your financial institution. It’s often more advantageous and less expensive in the end. Remember also that if you can’t provide the 20% down-payment, you’ll have to go through the CMHC to acquire mortgage insurance.

With this new knowledge, you should be well informed and prepared to shop around for the right type of insurance!

Get a Free Quote for your life insurance

Compare Different Life Insurance offers and select the Best, simply by filling out the from below

French

French