YOUR QUOTE IN 2 MINS

1 (844) 383-3686

Compare more than 20 Insurers to find the best offer

for your Cancer of Critical Illness Insurance

THE BEST WAY TO SAVE ON YOUR DAMAGE INSURANCE IS BY SHOPPING AROUND WITH THE HELP OF A PROFESSIONAL

FIND THE BEST DAMAGE INSURANCE IN NO TIME!

Just fill in the form and one of our partner insurers will find you the best solution.

"*" indicates required fields

Disability insurance for Mental Health in Quebec

According to a recent study, one out of five Quebecers suffers from a mental illness, and 8% of adults will be affected by severe depression during their lifetime.

For two years, the pandemic has brought to light this pathology which can strike all individuals, regardless of age, level of education, income, and culture.

A significant number of Quebecers consider depression and anxiety to be the most debilitating forms of disability.

Mental disorders are conditions that cause:

- Distress or disability

- Mental or emotional dysfunction

- Behavioral problems

- Suffering, pain, sadness, suicide (in the most serious cases

The most common mental illnesses are:

- Anxiety disorder

- Depression

- Bipolar disorder

- Personality disorders

- Alcoholism and drug addiction

- Eating disorders

- Suicidal thoughts or behavior

- Schizophrenia

Who can be affected by mental illness?

All Quebecers will one day be confronted with mental illness, either through their own personal experience or that of a loved one.

By the age of 40, almost 50% of the population will have or will have had a mental illness. This awareness is perhaps due to the fact that a greater number of workers are affected.

Mental illness affects everyone

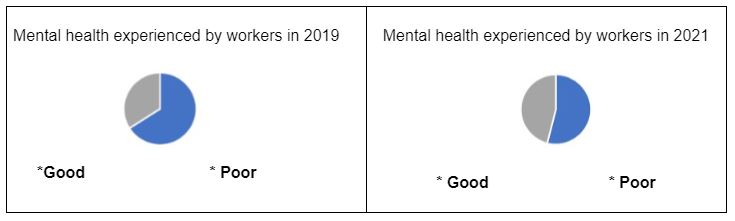

In 2021, more than a third (35%) of new long-term disability claims filed by 18- to 39-year-olds were related to a mental health problem. This trend has been on the rise since 2019.

What is disability?

Disability is the inability to work or carry out one’s usual activities due to illness or injury.

However, it is important to be aware of the definition of disability on the insurance contract.

It can vary from one insurer to another, and have major repercussions on your coverage and benefits.

Causes of disability:

- Injury

- Serious illness

- A mental health problem

- It can be short- or long-term.

What is disability insurance?

Disability insurance is designed to replace a portion of your income if you become disabled and unable to work or earn income.

Types of Insurance contracts:

- Group

- Individual

Government programs:

- Workers’ compensation programs

- Quebec Pension Plan Benefits

- Canada Pension Plan

Who is eligible for disability insurance in Quebec?

A mental health problem can arise at any time, and it can have a serious impact on your personal and professional activities.

32% of Quebecers who believe they have a mental health problem miss work compared to 12% of those who say they don’t.

To offset a potential loss of income, disability insurance is an appropriate solution.

This type of insurance can be taken out between the ages of 18 and 65. However, some insurers can extend the age beyond 65.

From age 50 onwards, it is also advisable to supplement your disability insurance with long-term care insurance to increase the level of critical illness coverage.

Reasons to buy disability insurance

If someone asks what your most valuable asset is, most of us would answer that it is our home or property. But the truth is that our ability to work or earn income is the most valuable asset that we possess.

A worker can earn millions of dollars over the years until retirement. This amount can be more than the value of any asset.

If you were to suddenly become unable to work due to illness or injury, you could suffer tremendous negative consequences to your finances.

Aside from physical injuries, mental health problems can also cause disability. In fact, mental health problems can be more debilitating and difficult to treat.

According to the Canadian Mental Health Association, nearly half of all people suffering from depression or anxiety have never consulted a doctor for their problem.

The majority feel that consulting a psychologist is a luxury that is mostly accessible to those with sufficient financial means.

Given the explosion in the number of people with one or more mental health-related symptoms, private insurance companies are now offering disability insurance specially designed to meet the changing needs of Quebecers.

These may cover prescribed medications and consultations with licensed professionals, such as:

- Psychologists

- Marriage and family therapists

- Social workers

- Eating disorder counselors

- Alcohol and drug counsellors.

How does disability insurance work?

Does your employer already offer group insurance? If so, some mental health expenses may be covered.

Note, however, that your group insurance doesn’t always reimburse the expenses incurred, and won’t allow you to receive 100% of your employment income in the event of disability.

You can choose to buy another disability insurance policy to cover an additional percentage and make up the shortfall.

Since group insurance coverage varies from one employer to another, it’s best to find out the details of your group insurance to protect your income.

You should also know that taking out disability insurance is voluntary; it is up to you to evaluate whether you need this coverage or not.

How much does disability insurance cost?

As with all types of insurance, the price of disability insurance is calculated based on several factors including:

- The selected type of plan;

- Contract duration;

- The member’s personal situation

- Age

- Gender

Age of insured | Minimum premium | Maximum recorded premium |

20 years | $19.30 | $48.10 |

40 years | $50.70 | $127.00 |

60 years | $72.20 | $182.20 |

Average cost of disability insurance premiums in Quebec

The cost of disability insurance is a percentage of your salary, often ranging from 1% to 9%.

By the age of 40, 50% of people will have experienced mental illness. It can happen to anyone at any time in our lives.

That’s why it’s so important to have protection from financial consequences to avoid the economic repercussions inherent in the cost of treatment or prolonged work stoppage.

What is long-term disability insurance?

Long-term disability insurance pays monthly benefits to people who cannot work due to a disability. People with permanent disability can receive benefits up to age 65.

This type of insurance protects you financially because it replaces your income so you can continue to enjoy the lifestyle you have while you were employed.

A study in 2019 found that up to 53,000 Canadians are approved for group long-term disability benefits every year for reasons such as chronic medical conditions and mental illness.

If you don’t have coverage, you have very few options for receiving long-term financial support. Most government programs have a capped amount.

Long-term disability insurance pays benefits regardless of the reason for the disability. It is the best way to get income protection.

FAQS on Disability Insurance in Quebec

The decision to take out insurance is not a simple one. It must be based on your specific situation, financial status, your needs, type of employment, among others.

To help you evaluate your needs and make the right decision concerning your insurance coverage, we have gathered some of the most common FAQS about disability insurance to guide you.

Who should buy disability insurance?

Although the majority of workers can benefit from disability insurance, the people who would have a greater need for it are:

- People performing physically demanding work

- Parents

- Sole breadwinners

- People with chronic injuries

- People with a history of mental health problems such as depression or anxiety

- People with medical conditions that could render them temporarily or permanently disabled.

Should disability insurance match your income?

While most of us would want disability insurance benefits to cover 100% of our income, it is not possible.

Disability benefits are generally based on how much money you make but it cannot be more. The usual percentage is from 50% to 80% of your average salary.

For example, if your salary before taxes is $8,000, your disability benefits can be up to a maximum of $6,400.

How can I use disability insurance benefits?

Disability insurance benefits can be used to pay your rent or mortgage, loan payments, living expenses, medical bills, and more.

Do I need disability insurance if I have coverage at work?

Most workers in Quebec are covered by group insurance from their employers. These plans vary depending on your company. It is important to understand that your group insurance coverage ends if you quit your job. It is a good idea to get an individual insurance policy to augment your group insurance and make sure you have coverage even if you lose or quit your job.

Are disability insurance payments tax free?

If you pay for your disability premiums entirely, you can receive tax-free disability benefits. This means individual policyholders don’t get taxed. For group insurance, if the employer pays part of the premium or all of it, the income from disability insurance is subject to tax.

What is short-term disability insurance?

Short-term disability insurance provided disability benefits up to a maximum of 6 months.

Compare the best disability insurance plans with free quotes

You can save time and money looking for the right disability insurance policy right here!

Our network consists of the best insurance brokers and insurers who can help you with free quotes to compare with no obligation.

Our partner brokers will also be happy to explain your options or make recommendations regarding your insurance needs.

Just fill out the short online form below to get connected to the best insurance professionals serving your area.

GET YOUR CANCER OR CRITICAL ILLNESS INSURANCE

by comparing 20+ insurers in one free request!

"*" indicates required fields

TYPES OF HOME INSURANCE OFFERED

CALL US TO REQUEST YOUR QUOTES OR FOR MORE DETAILS

Become A PartnerContact

Terms and Conditions

About Compare Insurances Online

Publications & Consulting

Compareinsurancesonline.ca is not an insurance company or an insurance broker but a web platform that connects users looking for insurance with insurance brokers.

The Top 12 Home Insurance Companies in Canada French

French