YOUR QUOTE IN 2 MINS

1 (844) 383-3686

Compare the premiums of 20+ Insurers in one simple request!

Fill out a Free Form and finally get your disability Insurance.

Get your free quote for disability insurance

An insurance broker will compare premiums and find the best offer for you.

What is the price of disability insurance in Quebec: Will it replace your income?

According to the Quebec Statistics Institute, the average salary of a person in Quebec is $24.23 per hour in 2017, which gives him an average weekly salary of $858.52. Does it need protection in case something unfortunate happens? What happens to an employee in case of an injury?

- If it happens at work, the CNESST (Commission for Standards, Equity, Health and Safety in Quebec) will pay for the costs until his recovery.

- If an accident occurs during a collision with a vehicle, the SAAQ (la société de l’assurance automobile du Québec) will pay the bill.

In the event that this disability does not fall under these agencies, his livelihood may drop significantly with adequate coverage. Disability insurance (also known as salary insurance), pays a person who has become disabled with monthly benefits for a fixed period. La Presse revealed in a report dated 1 October 2006 that 6 workers out of 10 are covered by salary insurance.

Do you have disability insurance?

Do you have disability insurance?

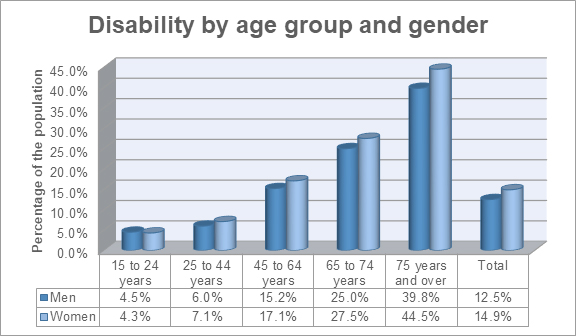

Many financial advisors recommend disability insurance to their clients for a good reason; Statistics Canada revealed in its 2012 report (revised on 15 February 2017) on disability among Canadians aged 15 years and over reported having a disability that limits their daily activities. That is almost 14% of the population in this country!

3.8 million citizens declare having a disability that limits their daily activities

This report also highlights that disability appears in the early 40s (43 years to be exact). Men, whose average disability is at 41.5 years of age, suffer from this condition much earlier than women (average age of 44.5 years) However, women are more likely to report a disability than men (15% for women versus 13% for men).

Here is a graph showing the prevalence of disability based on age and gender of an individual:

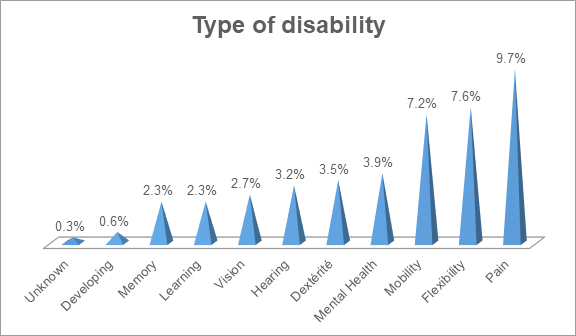

It is important to note that disabilities related to flexibility, mobility, and pain are the most prevalent. Around 12% of the country’s citizens (about 3 million people) reported one of these symptoms and many of them have more than one disability.

The following are types of disabilities that affect Canadians 15 years old and over:

In the unfortunate event that you become disabled, ask yourself these important questions :

- ✥ How will you feed your family?

- ✥ What will happen to your loans and debts?

- ✥ Who will pay your mortgage?

- ✥ Who will be responsible for paying bills for electricity, telephone, etc.?

Disability insurance (salary insurance) is a popular solution with more than half of Quebecers. Some people benefit from group insurance through a student or professional association. If you have salary insurance with your employer, check your contract to know what percentage of your income will be replaced. In general, your group disability insurance will cover between 60% to 85% of your taxable income. Secondly, study the details of your contract carefully to know the maximum duration of your agreement. Oftentimes, the benefits will protect your finances for a period of 24 months.

Your group disability insurance generally covers between 60% to 85% of your taxable income and will protect you for only 24 months.

Is it sufficient? If not, analyze your needs and do what is necessary for the security of your financial situation.

- ✓ If you perform a job wherein your group disability insurance is not adequate to cover the loss of your assets temporarily or permanently, purchase an individual disability insurance policy.

- ✓ If your employer does not provide salary insurance, look also at individual salary insurance coverage.

- ✓ If you are employed in a position without management, such as self-employed or a small business executive (or in partnership with associates), do not risk losing everything. Security from salary insurance will lift a huge weight off your shoulders.

What policy to take out ?

A multitude of insurance companies offers disability insurance. Which one will satisfy all your requirements? By filling out our form on this page (it is free and takes only 2 minutes to fill-out), you will compare more than 20 insurers without leaving your home. With the help of one of our partners (they are all insurers and insurance brokers) You will quickly receive a response that will provide you a quote tailored to your needs.

Disability insurance, salary insurance: how does it work ?

As a result of an illness or an unfortunate accident, you find yourself unable to do your job. What option do you have left? Disability insurance, popularly known as salary insurance, compensates the loss of your income for a specified time. Monthly benefits are paid to you until the end of a pre-determined period. Martin Drapeau, a financial security advisor and financial planner, says that : « Everyone should have disability insurance.»

La Presse published some time ago an interesting article entitled: « Disability Insurance: What you need to know ». It featured the testimonial of Madeleine Bourque, a 45-year old woman from Laval, who was deeply grateful to have disability insurance. At a time of major depression when she was unable to work for 9 months, her insurer paid her $1,500 a month which replaced the loss of her regular income. Her mortgage was paid!

« …everyone must have disability insurance. »

Martin Drapeau, financial security advisor, and financial planner.

Here are three things that insurance companies will always evaluate before issuing a disability insurance policy:

| Factors that insurers take into account | Reasons for Price Variation |

| Your health status |

|

| Your occupation (job) |

|

| Your age |

|

The ACCAP (l’Association canadienne des Compagnies d’Assurances de Personnes), informs in a brochure entitled « Guide to Disability Insurance » that one in three persons would be recognized as disabled for a period of at least 90 days prior to his 65th birthday. Everyone knows the importance of taking out life insurance but many people are unaware of the disastrous impact of a prolonged disability on their finances.

If you already have disability insurance, whether through group salary insurance or with a professional association, check with the plan administrator or your insurance broker about the benefits of your disability insurance. Prepare a list of questions so you don’t forget anything. The person responsible can usually show you the warranty booklet or a copy of the insurance contract. Take down notes and don’t be afraid to ask for clarification to understand the extent of your protection.

Here is a list already prepared to facilitate your work:

%

- ➢ Firstly, ask what percentage of your salary will be paid in benefits.

- ➢ What is the ceiling?

- ➢ Is your disability insurance coordinated with your other coverage?

When

- ➢ When will the benefits be paid?

- ➢ Is the waiting period similar if your disability is due to an illness rather than an accident?

- ➢ If there is a relapse, does the waiting period start again?

Restrictions

- ➢ Are there any restrictions or exclusions (pre-existing conditions that restrict you)?

- ➢ What diseases or types of accidents are not covered?

Health

- ➢ Does coverage increase only after a medical examination?

- ➢ Is evidence of health required to change certain clauses?

Definition

- ➢ What is the definition of disability stated in the contract?

Imposition

- ➢ Will premiums be waived if you become disabled?

- ➢ Will the premiums that were paid following an accident be reimbursed?

Some additional questions for you (concerning a group insurance plan):

- Can I cancel my group insurance plan at any time?

- Am I protected for a specific period?

- If the schedule of premiums is not guaranteed, what will the increase in cost be?

- If there is a strike or you go on leave (authorized), are you covered?

- Is it possible to convert a group insurance plan to individual insurance without a medical examination?

- Is the plan insured or not: a RASNA (uninsured benefits plan).

Questions to ask about your individual disability insurance:

- Will salary insurance pay for the deferred income tax (of your business) if you are self-employed?

- Will you be entitled to discounts on your premiums if you do not submit a payment within a certain period of time?

- If you can still work but at a slower pace, will you still receive benefits?

- Does your disability insurance have savings options to help you achieve your financial goals?

Let’s look at the principal rules and the definition of terms of disability insurance!

Some definitions: salary insurance, disability insurance, mortgage disability insurance, etc.

The lexicon of disability insurance is not very complex but let us look at the nuances of specific words. If the primary purpose of salary insurance always seems to confuse you, we will establish its function and value clearly. Its basic principles must be understood before embarking on detailed questions.

What is the definition of disability insurance or salary insurance ?

Disability is a permanent or temporary condition resulting from an accident, a physical or psychological impediment to doing your job. Disability can also result from a degenerative disease. Under the law, disability is defined as a mental or physical state that causes a person to be unable to support himself or herself.

However, the definition of « a disabled person » varies among insurers. See below two examples whose meanings are significantly different:

- You are incapable of performing a majority of tasks in your current job.

- You are no longer capable of performing the tasks for which you are qualified or for any job that you may become qualified based on your training or experience.

Here are some situations with disability:

- Following a heart attack, a plumber must rest.

- A person experiences a traumatic event and is diagnosed with a major depressive disorder.

- A painter breaks his arm while climbing a mountain and cannot work for two months.

- After several chemotherapy treatments, a customer service worker can no longer focus on his work.

- Prolonged convalescence after a camel accident during a trip.

- A stroke reduces an accountant’s ability to work with numbers.

Salary Insurance in brief!

Salary Insurance in brief!

Disability insurance (salary insurance) therefore replaces the income of the insured with benefits determined by the insurance contract. These monthly benefits will generally be deposited for a certain period (usually between 2 to 5 years). It suits entrepreneurs, self-employed individuals, and unprotected employees (group disability insurance) well.

Mortgage Disability Insurance

Mortgage Disability Insurance

The mission of mortgage disability insurance, what is it?

Mortgage disability insurance. This is protection that makes your payments to your mortgage in case of disability following an accident or illness. Usually, the premium is adjusted based on the actual balance of your mortgage and therefore proportional to the amount to be covered..

Automobile Insurance

Automobile Insurance

Automobile insurance in case of an accident.

If you get injured while driving a car, auto insurance pays compensation. Your contract determines if the auto insurance will be the first or second payer (who will be the first payer between a health insurance plan or a secondary source of income). Regardless, your benefits will have to be coordinated. Depending on your area, if it has adopted no-fault insurance, your rights could be clear: no choice for your secondary source of income unless there are catastrophic circumstances.

Credit Insurance

Credit Insurance

Credit insurance to the rescue

Do you want your credit card payments to be taken care of if you become disabled? Mortgage disability insurance is a form of credit insurance. More and more financial products are insurable, including bank loans, auto loans, etc. The period of payment for benefits is specified in your contract. Credit insurance will lift a heavy burden off your shoulders in case of disability.

Dismemberment Insurance

Dismemberment Insurance

Addition to an existing insurance: guarantee in case of dismemberment

This option is usually found in forms of insurance policies and offers payment of a lump sum for partial or total loss of your limbs or for loss of sight or hearing. Dismemberment insurance will often pay for modifications to your home to allow you to move around in your new condition.

Critical Illness Insurance

What does critical illness insurance do?

A diagnosis of a critical illness (cancer, heart disease, stroke, etc.) will have significant repercussions on your finances. Critical illness insurance will usually pay for the bills until you recover. While significant advances in medicine have improved the survival rates of people will critical illnesses, the costs associated with travel, home modifications, etc. are increasing without warning. Critical illness insurance coverage ranges from $25,000 to $2,500,000 depending on your choice.

To qualify for the lump sum amount of critical illness insurance, a clause in your contract stipulates a predicted survival time associated with diseases. Payment will be made when this period has passed.

Here are the common reasons to take out critical illness insurance in Quebec:

- It will provide you with help at home to manage the efforts of the people in your home.

- It will sometimes replace your total income and that of your spouse so you can get through this difficulty together.

- It will get rid of financial troubles like debts and minor expenses during your treatments.

- It will render financial access to remedies sometimes not covered by public or private health insurance.

Le Journal de Montreal published an article on Wednesday, November 8, 2017, which tackled the topic of disability insurance in a personal crisis. It was learned that most group insurance basically replaces one or two years’ salary. Would it be enough to cover your mortgage? Keep in mind that if you lose the job that provides you with this coverage, your protection disappears as well. One option (available only 1 month after your dismissal) to convert your policy to individual insurance exists, but your premiums could rise significantly.

Analyze your needs with a financial security advisor and ask your parents about your health predispositions. If you do not know your real parents (in case of adoption), get a DNA genetic predisposition test. The French television channel RMC reported precisely about predictive DNA tests for sale openly in the United States on May 25, 2017. They are becoming less and less expensive (from $200 to $500 on average) and you will know the risks of developing certain conditions that run in the family. While waiting for a molecular system that can correct genetic defects, give yourself the chance to foresee problems before they develop or avoid them completely!

Long-Term Care Insurance

Long-Term Care Insurance

Long-term care insurance, for whom?

In 2017, the chances of surviving until the age of 100 years old have never been greater. It goes without saying that many of these years will send Quebecers to hospitals for treatment of health problems. Long-term care insurance provides home care or at your preferred long-term care facility. This coverage pays you non-taxable benefits without having to prove your expenses with receipts. If you lose your independence or suffer from cognitive impairment, this coverage takes away the financial burden and provides the necessary support.

This coverage will help you regardless of your age. Disability can happen at any time. What would your income be if you suddenly become disabled? Disability insurance pays compensation, but have you calculated the costs of a long-term care facility or specialized care that will need to be paid for the rest of your days?

According to the figures reported by the ACCAP in their « Guide to long-term care insurance » :

- $1.2 trillion will be disbursed to pay for long-term care of baby-boomers over the next 35 years. Only half of this astronomical amount will be paid by governments.

- 25% of the Canadian population will be over 65 years of age in 19 years. At that time, one million Canadians will have developed some form of dementia.

- 74% of Canadians have no financial plan related to their long-term care in their retirement plan.

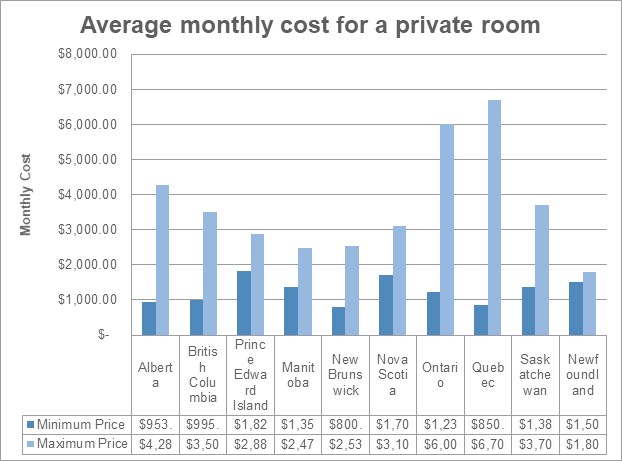

- The average monthly accommodation costs in an institution range from $900 to $5,000. The difference depends on the public funding your are entitled to and the type of room chosen (private room or semi-private).

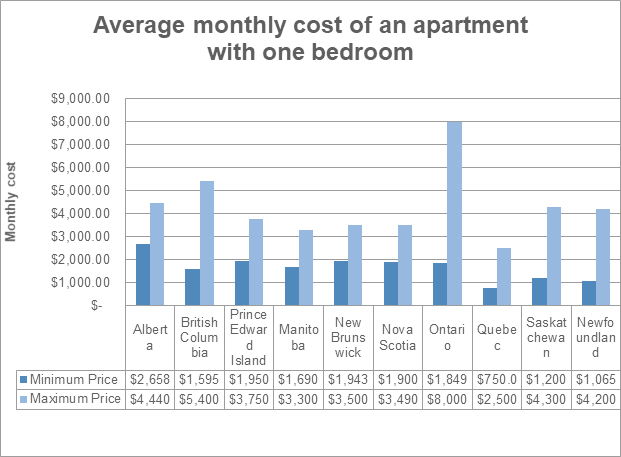

In Quebec, many people are unaware of the fees associated with retirement homes (we have included non-subsidized insitutions in this table). Here are the average costs per Canadian province provided by LifestageCare for a private room:

A second graph presenting the same thing for an apartment with one bedroom:

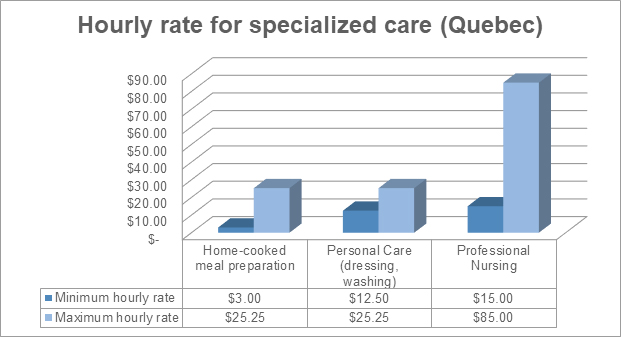

Home care can quickly eat away your budget. Housekeeping, nursing and personal care can cost between $12 to $90 $ per hour, depending on the province. Here is a summary of rates in Quebec:

Adding the costs of long-term care can quickly undermine your liquidity and savings. Imagine if you were currently paying for long-term care at $45 per hour (3 hours a day) for only 5 days a week, your expenses would be a little over $35,000 a year.

In the second example, you decide to stay in a long-term care facility since you can no longer look after your home. At $4,000 a month, your expenses would rise to $48.000 a year.

Unless we have a very important financial cushion, we note that in a few years, the majority of households in Quebec would not have the means to pay for this type of expense.

Travel Insurance

Travel Insurance

How does travel insurance protect you?

In Quebec and even across the country, if you go to a hospital or public medical clinic, the issue of fees don’t arise: your health insurance plan takes care of it. But what if you have the misfortune of getting sick while you are abroad? Travel insurance will relieve the fear while you are outside of Canada. Medical expenses vary from one place to another and medical care can easily run to thousands of dollars!

Travel insurance will drastically reduce costs in the event that your trip is canceled, or the theft or loss of your baggage, and the transport of your body if something should happen to you (check your policy to know the extent of your coverage.)

Life Insurance

Life Insurance

Life insurance will cost you nothing if…

… your policy provides a waiver of premiums if you become disabled. This will suspend the payment of your premiums and maintain your protection if your condition lasts for more than 6 months. Many insurers (in the case of individual life insurance) have clauses providing benefits to the insured who are terminally ill. Some companies even have clauses that apply to people with serious diseases that are not terminal. Some group insurances add a provision in the agreement that helps you save on life insurance premiums if your long-term disability insurance benefits are approved (if both policies are with the same company). Regardless, consult your insurer to learn more.

To learn more about life insurance, visit our article on the subject. It is entitled « Why take out life insurance before 30 years old in Quebec? ».

10 important questions regarding disability insurance

We will discuss in detail the 9 principal questions regarding disability insurance below. Firstly, you must obtain information about disability insurance from separate sources. These are:

- Personal insurance (individual)

- Public insurance schemes (government)

- Group insurance plan (with certain associations, unions or even some employers)

- Special purpose insurance (auto insurance, dismemberment insurance or critical illness insurance)

How to calculate the amount you need for disability insurance?

There are many factors to consider when determining the amount you need for disability insurance. Before you estimate the amount, write down your responses to these 6 essential questions and their sub-questions:

What are your current financial resources?

- What is your salary?

- What percentage of your salary is necessary?

- Do you have investments?

- Do you have adequate resources to be able to live for a certain time?

What are your family obligations?

- Do you have responsibilities as a guardian or parent?

- How many people depend on your income?

What are your debts ?

- Who will pay for your car loan if you become disabled?

- Who will pay for your mortgage if you are incapable?

- How long can you pay for your debts using your savings?

How much are your monthly expenses right now ?

- How much do you need to live each month?

- Would you be amenable to reducing your lifestyle?

Can you change jobs without difficulty ?

- Can you find another job in your field easily?

- Would you agree to change jobs?

What are your plans for the future and are they certain ?

- What would happen to your retirement plan if you become disabled?

- Can you give up plans for your family and your personal plans?

- What are the essential projects?

- The document that determines your needs

- The document that shows your current coverage

- The document that shows your other sources of income

Document 1: Your Needs

- Add all expenses related to your lifestyle in one column.

- For annual expenses, divide by 12 and write them down, too (if you have plans for major renovations that cannot be postponed, don’t forget to include them).

- Then, in a column on the right, list only essential expenses. Don’t sacrifice anything: many people remove expenses related to housing but don’t fall into this trap. Disability often requires home modifications to be congruent to your needs.

- Compute the total of your expenses. These are your actual needs.

Document 2: Actual Coverage

- List down in one column your existing coverage (group salary insurance, disability insurance provided by your professional association, etc.).

- Write down the average amounts in benefits that you are entitled to in a column on the right (remember that the amounts are coordinated, it cannot exceed 85% of your regular income).

- Add-up your total coverage. This is your coverage in the event of a disability.

Document 3: Other Sources of Income

- On the left-hand column, list down your other sources of income (dividends, universal life insurance payments, etc.).

- On the right, note the estimated amounts you expect to receive from each source.

- Add-up the total of your other income. This is an additional amount that could change your needs.

You just have to compare your coverage with your expenses to establish your actual disability insurance needs. To better analyze the results, present your documents to a finance professional such as a financial security advisor or a financial planner.

What is the price of salary insurance in Quebec?

In general, individual disability insurance has a fixed premium until you turn 65. In comparison, the premium for group salary insurance varies based on the average age of the company or the association where you belong (reviewed every 12 months). Some factors are considered when establishing pricing:

- Depends on your job (does your job have a high risk of injury?)

- Depends on your salary (your average income will be calculated)

- Depends on your status if smoker or non-smoker

- Depends on your age (an average of your age group in your type of industry)

- Depends on your type of salary insurance (individual disability insurance is more expensive)

- Depends on the choice of the waiting period (some group disability insurance policies do not allow this option to be changed)

- Depends on your desired benefit period (the longer it will be, the higher the premiums)

When talking about disability insurance waiting period, we are talking about…

After disability, there is a certain number of days of waiting before you can receive your benefits. This period is indicated in your contract. From one contract to another, this waiting period can increase or decrease. If you do not have a copy of your disability insurance policy, contact your insurer to verify. At the time of signing, you will have to choose from 30 days, 60 days, 90 days, or 120 days. If your finances are in good condition, (if you have adequate savings in the bank), choose a longer waiting period to reduce your premiums.

Remember that most employers offer sick leave. Inform them of your intention to take sick leave during this waiting period if you think you need the money.

How does disability insurance tax work?

You may have to pay tax on your disability benefits paid by your insurer. Again, the best way to know is to contact your insurance company.

Two cases may apply:

| Are you paying for your disability insurance? | In this case, here’s what happens… |

| Yes | If you pay for your entire disability insurance without a contribution from your employer, your benefits during a period of disability will not be subject to tax. |

| No | If your union, employer, or an association pays for a portion of your disability insurance, the benefits paid during your disability will be taxable. |

| I am not sure | In case you are not sure and you don’t have a copy of your agreement, contact your insurer to clarify this. |

Some people may choose to do minor work during a period of disability. Take note! Many people encounter another problem. Here is an example that puts in perspective the effect of a secondary livelihood:

![]() Simon is a freelance journalist in Quebec. During his vacation in Charlevoix, he seriously injured his hand. He cannot work and his insurer has been paying his disability benefits since. To stay in shape, he helps his friend with his small business. He receives a small salary.

Simon is a freelance journalist in Quebec. During his vacation in Charlevoix, he seriously injured his hand. He cannot work and his insurer has been paying his disability benefits since. To stay in shape, he helps his friend with his small business. He receives a small salary.

When the insurance company learned that he is earning money, it adjusted the benefits accordingly. Simon thought he would earn more at the end of the month, but that is not the case.

If your situation is similar to Simon’s, contact your insurer to know the consequences of earning a secondary income.

Am I covered by the government: what are public disability insurance plans?

The site « Authority » in its report on disability insurance informs us of public disability plans that offer benefits without you having to pay premiums to an insurer. Are you eligible for these public plans? Sometimes these amounts are added to your disability benefits but usually, your insurance company will coordinate these amounts with these policies. The insurer will often limit its financial contribution according to your allowances offered by public disability plans.

Here are the main government services that will cover some forms of disability :

| CNESST | SAAQ | RPC/RRQ | |

| Name of the organization? | Committee on Standards, Equity, Health, and Safety. | Société de l’assurance automobile du Québec. | Canada Pension Plan and Quebec Pension Plan. |

| Administered by whom? | Provincial bodies | By the government of Quebec | Federal and provincial governments. |

| Type of disability (caused by what)? | If your injury occurs during your employment, the CNESST will pay benefits. | If you get injured or die during a traffic accident, the SAAQ will pay benefits. | If your disability becomes permanent, you may be eligible for disability pensions. |

| Funded by whom? | The government of Quebec. | The government of Quebec | Employees and employers with their CCP and QPP contributions. |

| Are there any restrictions? |

|

|

Must have contributed to the CCP/QPP :

|

| For more details, here are their websites : | The website of CNESST | The website of SAAQ | The website of Retraite Québec |

What is individual disability insurance?

Individual disability insurance is purchased by one person at a time. The self-employed should undoubtedly have protection for loss of income since they receive no outside help. There are many benefits to choosing your criteria or individual disability insurance:

- ✓ Choose the length of coverage that suits you best depending on your financial situation.

- ✓ Decide on a waiting period to lower the cost of your premiums.

- ✓ Maintain your coverage even if you lose your job.

The self-employed should undoubtedly have protection for loss of income since they receive no external support.

How to apply for individual disability insurance?

Be aware that your application will probably be scrutinized by the insurer. When you submit your form through an insurance broker, the information you provide will determine the cost of your future premiums. With the details you will disclose, you will inform them of :

- Your occupation.

- Your current income.

- Your hobbies.

- Your state of health.

In some cases, a medical examination or additional information may be required. Don’t be afraid! Very few people are denied disability insurance. If your financial or health condition is a problem, a surcharge may be added. Is your profession high risk? Adjustments will be made such as a shorter benefit period or a longer waiting period.

If I have health problems, will I be denied my disability insurance?

Not necessarily. Insurability is based on a multitude of criteria. Be honest with your insurance broker and he will shop for insurers who accept people who are a little more at risk. If you are refused by all insurance companies, check with your insurance broker for life insurance. The criteria are different and you may be able to attach additional protections.

What does group disability insurance mean?

This form of disability insurance is often called « salary insurance ». It is offered to members of an association (a professional association or a public or private enterprise). In the majority of cases, you have an obligation to join and there are restrictions on your choice of insurance.

The procedure for taking out this type of disability insurance usually rests with the employer or your union. It often happens that a company with thousands of employees does not require their members to complete a medical form. In contrast, a more modest association will not have this option to join their plan. An individual may be refused for medical reasons. In addition, medical information will often be required for each employee in order to assess the risks they represent.

What does short-term disability insurance cover?

To fully understand short-term disability insurance, see the table below:

| Questions about short-term disability insurance | Answers |

| When does it come into effect? | Compared to long-term disability insurance, it comes into effect beforehand. |

| How long is it valid? |

A specified period. Usually, it is for a few weeks. |

| How much will you receive? | An established percentage of your average salary. Usually, you will have less than 70% of your regular income. |

| Are there other options? |

If you do not have short-term disability insurance, look up the section on public disability plans (you may qualify). |

Long-term disability insurance: is it forever?

What about long-term disability insurance? See useful information for this type of salary insurance in the table below :

| Questions about long-term disability insurance | Answers |

| When does it come into effect? | It comes into effect when your short-term benefits or work insurance is up. |

| How long is it valid? | Your contract will specify a maximum period. Some agreements allow payment of disability benefits until age 65. |

| How much will you receive? | This calculation appears in your contract. |

| Is there a waiver of premiums? | If you become disabled, some contracts provide a waiver of premiums for as long as you remain in this condition. |

Who will approve your salary insurance: your insurer or your doctor?

A popular myth has led many people to believe that the doctor has the final say in the acceptance of disability status. This is not the case!

Since the insurance company holds the contract and is the legal entity responsible for paying the benefits, it will decide (based on all the information it collects during its investigation) on the ruling on your situation. This determines whether or not you are entitled to disability benefits as stipulated in your contract.

Who to turn to if your disability insurance is denied?

Some inaccuracies or communication problems can arise between the insurer and the insured regarding disability insurance. If you find yourself in this situation, get in touch first with your insurer to resolve the confusion.

If your insurance company is wrong about you and your case becomes complicated, there are legal measures that can help you. File a complaint with the ’AMF (Autorité des marchés financiers) by visiting their website. An Information Centre agent will listen to your complaint and guide you in the next steps.

How to choose from among the different types of disability insurance?

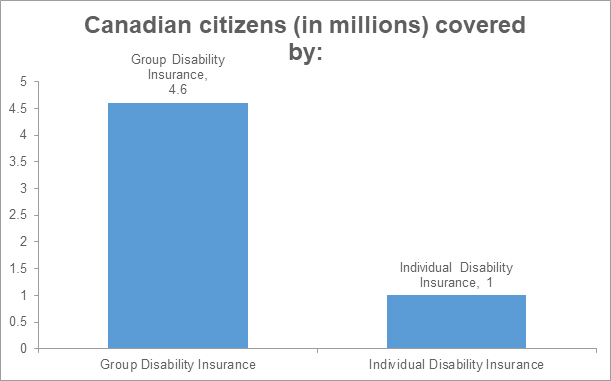

In Canada, almost one million citizens have their own disability insurance policies ( date from the Canadian Life and Health Insurance Association). Since we have already discussed the types of salary insurance above, let’s compare them according to their popularity (statistics obtained from the 2015 edition of « Facts about Personal Insurance in Canada » published by the CLHIA):

To better distinguish the differences between these coverages, compare them using this table to better understand the pros and cons of each product before dealing with the major categories of salary insurance contracts:

| Questions | Individual Salary Insurance | Group Salary Insurance |

| Did you lose your job? | You keep your policy. | Generally, you lose your policy. |

| How complex is the claims process? | Longer than group disability insurance. | Simplified. |

| How much? | More expensive | Less expensive. |

| Are there medical exclusions? | Quite often, yes. | Large companies facilitate underwriting (unless you suffer from a severe medical condition 3 to 12 months after your employment). |

| Are there other options? | They are all available. | It is normally uniform for the entire company or association. |

| What is the definition of disability? | Very clear and specific to your job. | Wider for you to return to the market faster. |

| Can you claim part of your salary? | Yes. | No. |

| Do you need to present evidence of health? | At contract signing only. This is the main factor for determining your premiums. | Not always. If you work for a big company, you can be automatically accepted. |

| Does smoking change the cost of your premiums? | Yes. You will see a difference of 10% to 30% of the cost of premiums between smokers and non-smokers. | Not always. If you work for a big company, you can sometimes pay the same amount. |

| Who does the policy belong to? | You. | Your employer. |

In short, if you already have group salary insurance, calculate if this coverage will be sufficient in the event of an unfortunate incident. See our section on « How to calculate the amount you need for disability insurance? » to know your financial needs.

Three categories of salary insurance decrypted for you!

When shopping for salary insurance in Quebec, you will quickly learn that there are broad categories of this type of policy. If you are looking for the most comprehensive salary insurance, Individual Disability insurance offers you more detailed and flexible coverage. When you want to secure your personal finances and that of your family, it is best to take out insurance that will meet all of your needs.

Guaranteed Renewal of Salary Insurance: explanation.

In this type of contract, the insurer has the obligation to renew your salary insurance. Take note that the insurer has the prerogative to increase your premiums (this right is only allowed if the insurer increases premiums for a whole category of insured). The insurance company can modify the conditions of the agreement (usually every 12 months).

Here are some situations that can boost your premiums (or at least add exclusions* to your policy) :

- If you lose your job or just decide to change jobs.

- If your medical condition deteriorates.

- If your salary increases or decreases.

* What do we mean by exclusions ?

* What do we mean by exclusions ?

- Example: If you develop back pain or depression that has been diagnosed, the insurer will not compensate loss of income due to these conditions.

What is non-cancellable disability insurance?

Throughout the term stipulated in your salary insurance policy, the insurer cannot cancel your policy or increase your premiums. You can find non-cancellable disability insurance often called « non-cancellable disability insurance with renewal guarantee » or « irrevocable salary insurance ».

Usually, your contract will end when you turn 65 years old, which is the best type of salary insurance in Quebec. Director Claudine Cloutier of Cloutier Group (a financial services firm) says that irrevocable disability insurance is: « … the Cadillac of disability insurance! ». The cost of this type of coverage will cost more, but since your contract is irrevocable, no matter if your income or your health condition deteriorates, your non-cancellable disability insurance policy will support you and your benefits will be paid.

« Irrevocable disability insurance, it is the Cadillac of disability insurance! »

Claudine Cloutier, Director of the financial services firm, Cloutier Group

This type of salary insurance requires greater risk from insurers and they are cautious when it comes to providing this type of coverage. Generally, if you have a very stable job or a high income, such as a doctor, a dentist, or a lawyer, you are more likely to get this wonderful type of coverage. On the other hand, a self-employed individual in a start-up project would certainly be refused coverage with this type of policy. If after a few years, his earnings become high enough and more predictable, he would then have the opportunity to get irrevocable disability insurance.

What is commercial salary insurance?

With commercial salary insurance, your insurance company made decide to renew your policy as is by increasing your premiums (due to previous regulations) or even refuse to extend coverage.

Is there salary insurance without a medical examination?

Yes. Many insurance companies are looking for ways to satisfy consumer demands. Disability insurance without a medical exam is receiving more and more interest for its innovative approach. Many people, restricted in their choice of policies because of age or medical conditions, turn to salary insurance without medical examination (also called guaranteed membership).

The table below will give you an idea of the costs of this product. This is based on average market prices in 2017. Do not consider these rates as definitive.

Here are some details offered by disability insurance without medical examination:

| Criteria under observation | Details of salary insurance without medical examination |

| Benefits offered | From $400 to $2,500 per month depending on the contract. |

| The Average period of compensation | Most insurers limit the period of compensation for this type of policy to 24 months. |

| Renewal Limit | At age 65, this coverage disappears. You must be between 18 to 55 to be eligible for this coverage. |

| Cost of premiums | You can usually choose a period of 10 or 20 years when you want this protection. Depending on your age, if you smoke and your choices, your premium will be determined. The premium is not guaranteed, that is to say, the insurer can add a surcharge upon renewal. |

| Waiting period | 90 days after the diagnosis of a disability. |

| Type of contract | You choose between 10 or 20 years at the start. |

| Who is the beneficiary? | You, the owner. |

| Waiver of premiums | After a period of 3 months of complete disability, the insurance company will waive the subsequent premiums until the time that the benefits cease. |

| Retroactive indemnity | After six months of full disability (paid), the insurer pays for the benefits of the waiting period. |

| Reimbursement of premiums | After 20 years have passed without a claim, 75% of the amount of your paid premiums will be reimbursed. |

| What are the disabilities covered? |

|

| Exclusions |

|

| Pre-existing conditions | If you have a pre-existing medical condition (within a period of 12 to 24 months after signing the contract), the insurer will only reimburse the premiums paid by the insured. |

Who are the best insurers offering disability insurance?

If you are trying to find the best disability insurance, you’ll find a very long list of insurers qualify. They all offer different solutions that include a variety of clauses that will allow you sometimes to protect certain financial aspects that may make you anxious. We have enumerated a non-exhaustive list of insurance companies offering disability insurance in one form or another.

To better navigate this complex maze, take the time to complete the free form on this page to compare +20 insurance companies with the help of one of our partners.

| Name of company | Founded in…. | Number of employees | Headquarters | Disability insurance products |

Manulife Financial |

1887 | 47 000 | Toronto, Ontario |

|

Humania Assurance |

1874 | 206 | Saint-Hyacinthe, Québec |

|

Canada-Life |

1847 | 19 000 | Winnipeg, Manitoba |

|

Desjardins Insurance |

1900 | 47 655 | Levis, Québec |

|

Industrial Alliance |

1892 | 6 000 | Quebec, Quebec |

|

SSQ Financial Group |

1944 | 2 000 | Quebec, Quebec |

|

Sun Life Financial |

1871 | 30 000 | Toronto, Ontario |

|

RBC Insurance |

1864 | 2 500 | Mississauga, Ontario |

|

Blue Cross Insurance Quebec |

1942 | 364 | Montreal, Quebec |

|

CIBC Insurance |

1867 | 37 000 | Toronto, Ontario |

|

Compare disability insurance quotes with this innovative platform

Take two minutes of your time to compare + 20 insurers. Just fill out the form on this page and mention your requirements and criteria. One of our partners, which are all insurance brokers and insurers, will reveal to you an offer.

Our form is free and this service does not commit you to anything.

Get your free quote for disability insurance

An insurance broker will compare premiums and find the best offer for you.

French

French